Death Tax Will Die in 2010: Don’t Raise It From the Dead. Senate Now Likely to Allow Tax to Zero Out January 1, 2010 Plans to Pass Retroactive Legislation Next Year.Yesterday, key Senators conceded they will likely be unable to keep the estate tax from falling to zero starting January 1, 2010 in the face of widespread opposition and will have to take the fight into next year. “Both Senators Max Baucus and Harry Reid have admitted that Congress will likely have to allow the estate tax to fall to zero in 2010 based on current legislation,” says Dick Patten, President of the American Family Business Institute (AFBI), an organization representing family businesses and farms. “This is the first step towards victory for family businesses and farms. Unfortunately, however, the death tax fight is far from dead. In fact, Senator Max Baucus has said that he plans to fight for a retroactive death tax early next year.” “Instead of looking to pass retroactive estate tax legislation, Congress should allow the rate to stay at zero. This would be a significant boost to family businesses, allowing them to add the new jobs to our economy that we so desperately need,” Patten said.A new study by Antony Davies for AFBI’s research foundation – recently highlighted in the Wall Street Journal – shows that the estate tax impacts small firms disproportionately versus large firms by encouraging well-capitalized companies to gobble up smaller ones at the owner’s death. The result is that the estate tax serves only to promote the concentration of wealth by preventing small businesses from being passed on to heirs.Specifically, the study points out:1. Eliminating the estate tax would increase the annual growth in the number of businesses by 4.5 percent to almost 6.5 percent. At current numbers, this means approximately 100,000 additional firms annually. At an average of 20 workers and $800,000 payroll per firm [2006 U.S. Small Business Administration data], those 100,000 additional businesses will create 2 million jobs, generate $80 billion in labor income, and increase payroll tax revenues by more than $20 billion annually.2. Every 4.5 percentage point increase in the tax per decedent (the average annual increase since 1993) results in an additional 6,000 small firms being eliminated or absorbed by large firms each year.3. For every $1 increase in tax revenues, state and local governments lose almost $3 in non-estate tax taxes. Eliminating the tax would increase state and local tax revenues annually by approximately $9.3 billion.4. The estate tax puts family owned businesses on a non-competitive footing compared to publicly traded corporations. As entrepreneurial activity mostly occurs at the small business level, the estate tax discourages innovation.Other foundation studies show that repealing the estate tax would actually add between 1.5 and 2 million jobs to the economy and increase government revenues by as much as $23.3 billion annually.“There’s simply no reason to resurrect the estate tax now that it’s gone, especially given the that the tax is killer to business, jobs and the economy,” says Patten.

Also on FingerLakes1.com

-

Invasive beetle threatens Cornell University’s ash trees

Cornell University says it will cut down more than... -

Cayuga County Sheriff’s Department participates in No-Shave November and No-Shave December

Sheriff Dave Gould announces that numerous members of the... -

Oaks participates in Toys for Tots collection

Assemblyman Bob Oaks is partnering with the Marine Corps... -

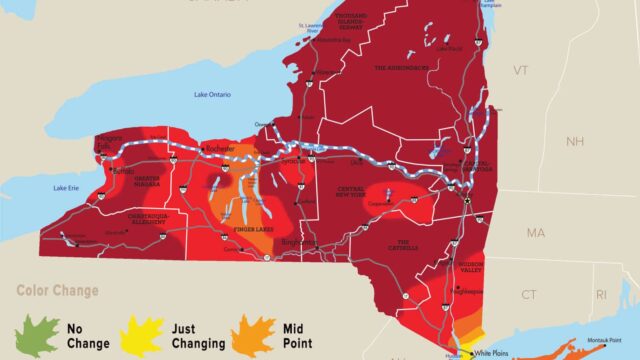

FOLIAGE REPORT: Finger Lakes primed this weekend for viewing

This will be the weekend to get out an... -

Marshall Exteriors ranked #37 in the Rochester Top 100

Marshall Exteriors, an Upstate New York leader in exterior... -

SUNDAY CONVERSATION: Money will play a big role locally on Election Day

Are voters energized for the upcoming elections? Midterm elections...